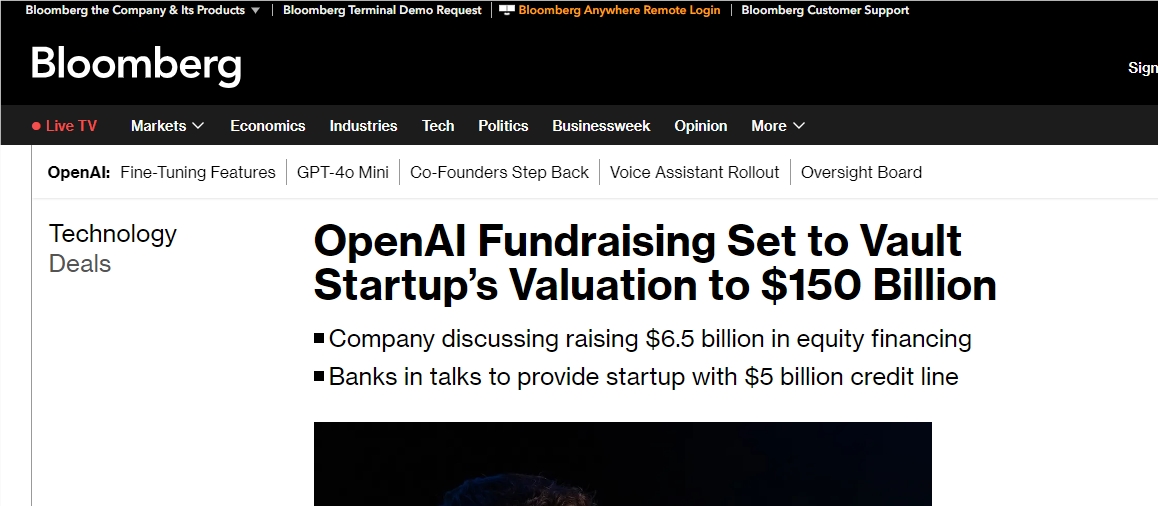

Recently, AI giant OpenAI is engaged in a new round of financing negotiations, targeting a valuation of $1500 billion.

According to Bloomberg, OpenAI aims to raise $6.5 billion from investors and plans to apply for a $5 billion revolving credit facility from banks.

This would make OpenAI's new valuation 74% higher than the $86 billion it secured earlier this year through a preferential purchase right.

OpenAI's high valuation is largely due to its popular chatbot, ChatGPT, which has made a significant impact in the market, quickly positioning OpenAI as a major player in the AI industry. Led by Sam Altman and backed by tech giant Microsoft, the company has reignited Silicon Valley's interest in the AI field.

Additionally, Forge Global Holdings, a marketplace platform focused on private securities trading, has also included OpenAI in its list of "private seven giants." This list includes well-known companies such as Microsoft, Apple, Alphabet (Google's parent company), and Tesla.

Although OpenAI has not officially responded to this financing plan, the market is filled with anticipation. Thrive Capital, the main lead investor in this round, has also not commented on the matter.

OpenAI is further consolidating its leadership position in the AI industry through this financing, demonstrating its importance and influence in the global tech sector.

Key Points:

💰 OpenAI is conducting a financing round with a target valuation of $1500 billion.

🚀 Plans to raise $6.5 billion from investors and apply for a $5 billion credit loan from banks.

🌟 OpenAI's rapid rise as a leader in the AI field is attributed to the success of ChatGPT.