Broadcom announced a quarterly revenue forecast that exceeded Wall Street expectations on Thursday, and it anticipates a surge in demand for its custom AI chips in the coming years.

Discover Popular AI-MCP Services - Find Your Perfect Match Instantly

Easy MCP Client Integration - Access Powerful AI Capabilities

Master MCP Usage - From Beginner to Expert

Top MCP Service Performance Rankings - Find Your Best Choice

Publish & Promote Your MCP Services

Broadcom announced a quarterly revenue forecast that exceeded Wall Street expectations on Thursday, and it anticipates a surge in demand for its custom AI chips in the coming years.

Welcome to the [AI Daily] column! This is your daily guide to exploring the world of artificial intelligence. Every day, we present you with hot topics in the AI field, focusing on developers, helping you understand technical trends, and learning about innovative AI product applications.

During Alibaba's Qwen App Spring Festival event, over 130 million users utilized AI assistants for services like ordering milk tea and stocking up on New Year goods, with 'Qwen Help Me' used 5 billion times, integrating AI deeply into holiday consumption. Post-launch, AI-driven movie ticket purchases saw significant growth.....

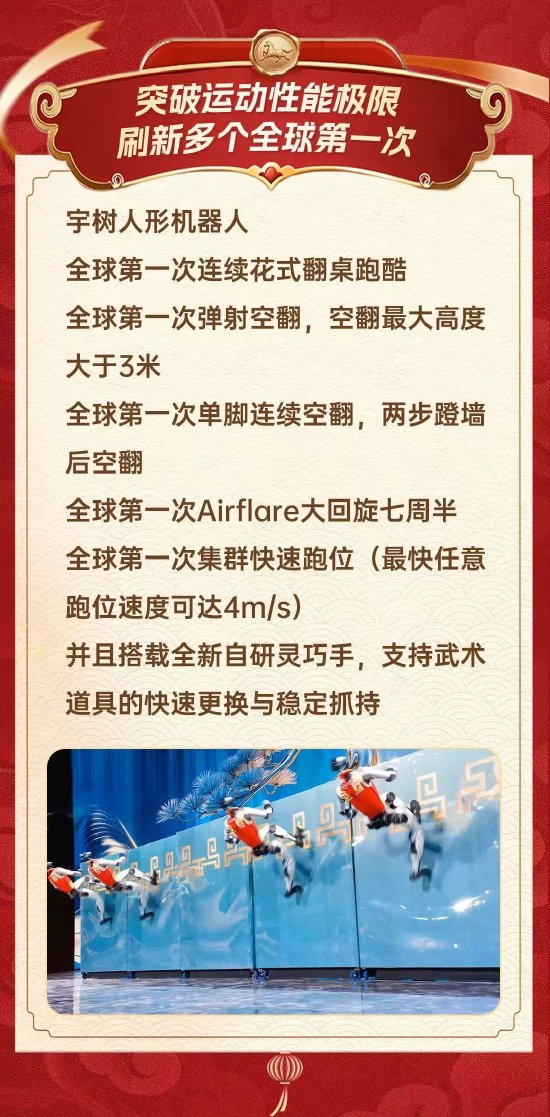

At the 2026 Spring Festival Gala, Yushu Humanoid Robots performed the martial arts routine "Dance BOT" with children, breaking multiple motion limits: vault height exceeds 3 meters, performing continuous one-foot flips, reaching a maximum running speed of 4m/s, and completing high-difficulty actions such as somersaults and wielding sticks and swords, demonstrating excellent stability and flexibility.

On the eve of the 2026 Chinese New Year, the CCTV Spring Festival Gala introduced AI-based real-time interactive creation for the first time. Doubao, a platform under ByteDance, served as the core platform, with a total of 1.9 billion AI interactions. Among them, the "Doubao New Year" activity generated over 50 million New Year headshots and 100 million greetings. AI-generated images and New Year greeting messages became a new trend for the Spring Festival. The interaction enthusiasm reached its peak at 9:46 PM on the eve of Chinese New Year when the host of the Spring Festival Gala announced it.

JD.com open-sourced the large model JoyAI-LLM-Flash, with 4.8 billion parameters and 3 billion activated parameters, pre-trained on 20 trillion text, featuring advanced knowledge comprehension, reasoning, and programming capabilities. It adopts the FiberPO optimization framework, combining fiber bundle theory and reinforcement learning, using the Muon optimizer and dense multi-Token prediction technology to solve the instability problem in model scale expansion.

Musk predicts that by 2026, AI will generate efficient binary code directly from requirements, bypassing traditional programming languages and source code, potentially making programming jobs obsolete.....

After the release of the MiniMax M2.5 model, it was quickly integrated into over 50 platforms, and the M2.5-highspeed model was launched, with an inference speed of 100 TPS, three times that of similar products. At the same time, three types of Coding Plan packages were released, and users can enjoy a 90% discount by inviting friends, continuously improving AI service efficiency.

American host David Green sued Google, accusing its AI tool NotebookLM of generating a podcast male voice that illegally imitates his voice, saying 'My voice is my soul.' Green stated that after the feature was launched, friends and colleagues asked whether it was recorded by him. After comparison, he confirmed the infringement.

Tencent WeChat has introduced a new feature for the Spring Festival. Users can create a "New Year Greeting Moments" by using the Yuanbao App, which triggers a golden moments effect. Liking someone else's golden moments may bring a red packet. At the same time, WeChat has added an AI New Year Greeting Song creation function, allowing users to compose personalized songs in "Listen and Watch." After the update, users can also add decorations to enhance the festive atmosphere.

TikTok Group announced that the CCTV Spring Festival Gala will first deeply apply the domestic AI video generation model Seedance2.0, marking a major breakthrough in China's AI video technology. The model was developed by the Douyin team and has been integrated into multiple Douyin platforms, allowing users to quickly generate short videos through prompts.

Peter Steinberger, founder of OpenClaw, announced his joining of OpenAI. OpenClaw will transition into an independent foundation, focusing on the development of personal AI agents. Steinberger emphasized the open-source philosophy, stating that joining OpenAI is a step toward realizing his vision.