Colin Angle, one of the co-founders of the Oomba robotic vacuum, is raising funds for his new home robotics project.

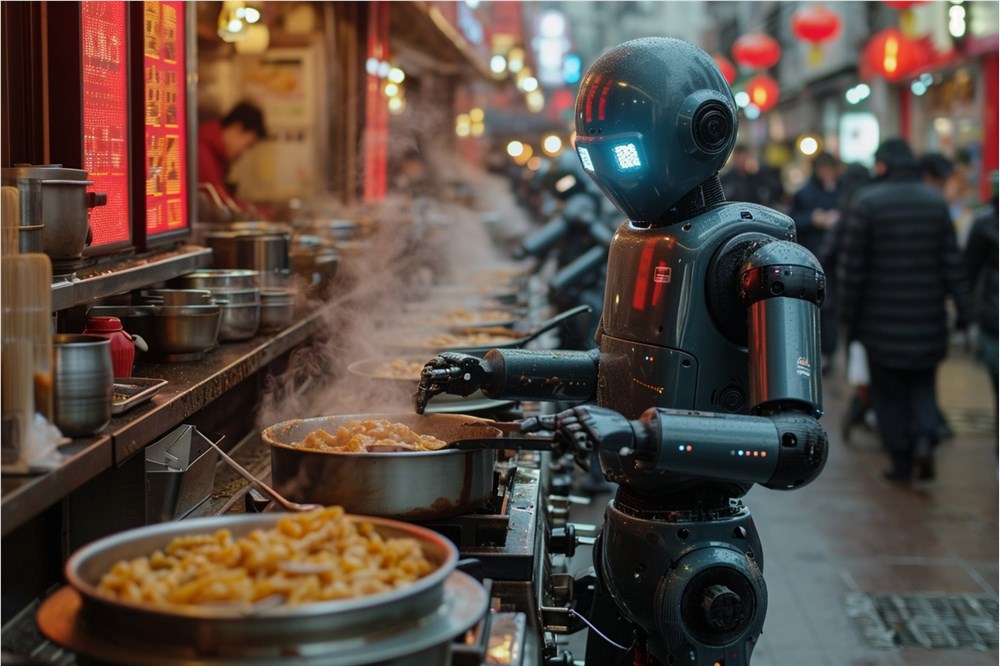

Image Source Note: Image generated by AI, image licensed from service provider Midjourney

Colin Angle, one of the co-founders of the Oomba robotic vacuum, is raising funds for his new home robotics project.

Image Source Note: Image generated by AI, image licensed from service provider Midjourney

Welcome to the [AI Daily] column! This is your daily guide to exploring the world of artificial intelligence. Every day, we present you with hot topics in the AI field, focusing on developers, helping you understand technical trends, and learning about innovative AI product applications.

With the rapid development of AI large language models in China, the investment and wealth management field is undergoing an unprecedented transformation. More and more investors are relying on AI for wealth management. Through "AI for financial planning", they find that AI can provide efficient investment advice and risk management solutions, helping them better seize market opportunities. In this new era, AI is no longer just a buzzword in the tech world; it's increasingly becoming the "financial advisor" in the hands of investors. Many experienced investors have noted AI's powerful information processing capabilities.

Colin Angle, co-founder and former CEO of iRobot, has announced his return to the robotics field by founding a new startup, Familiar Machines & Magic, focused on developing an innovative home health and wellness robot. According to the Boston Globe, this robot may take the form of an animal or 'pet', aiming to provide companionship to family members while assisting in health management. Familiar Machines & Magic

Colin Angle, co-founder of the renowned Roomba vacuum maker iRobot, is raising funds for his new home robotics startup Familiar Machines. According to documents filed with the SEC, Familiar Machines is aiming to raise $30 million and has already secured $15 million from eight investors. Image source note: The image is AI-generated and licensed from service provider Midjo.

In the current market, AI-driven coding assistant startups are emerging one after another, with Augment, Codeium, Magic, and Poolside among them. However, Cursor has become the most popular product. Its developing company, Anysphere, had an annual revenue of $4 million in April this year, which skyrocketed to $4 million per month by last month, growing at a rate far exceeding other coding assistant providers. Such rapid growth has attracted the attention of numerous venture capitalists.

Musk is in financing talks with several large investors from the Middle East, aiming to raise funds for his artificial intelligence startup xAI, with a target valuation approaching $45 billion, nearly double the company's valuation a year ago. According to sources familiar with the matter, xAI is in preliminary discussions with both new and existing investors to seek new funding to compete with OpenAI. OpenAI recently completed over $10 billion in debt and equity financing, while Anthropic and large companies like Google and Meta are also involved.

Recently, OpenAI faced a wave of executive departures, with the exit of three senior management members drawing widespread attention. To alleviate investment concerns, the company's CFO, Sarah Friar, communicated a positive message to the public via an email. In the message, she reiterated that OpenAI will continue to focus on developing artificial intelligence technologies that benefit investors, demonstrating the company's confidence in the future. Friar revealed that OpenAI's ongoing $6.5 billion funding round has been oversubscribed, with expectations of completion soon.

According to foreign media reports, OpenAI is currently in late-stage negotiations for a massive funding round, with a valuation potentially reaching $150 billion. Sources have revealed that the company has requested investors to contribute at least $250 million. Previous reports indicated that OpenAI is close to securing a new funding round of $5 to $7 billion, led by Thrive Capital, which has pledged to invest $1 billion. Microsoft, NVIDIA, and Apple are in discussions regarding investment matters. One insider stated that these companies...