Disclaimer: This article is from the WeChat public account "E-commerce Online," authored by Tangguo, and authorized for republication by Stationmaster Home.

"County Brahmin" and "County Madam" have become unavoidable buzzwords in the consumer field.

Once upon a time, when discussing "She Economy," urban white-collar workers were the market's primary focus. However, with the generational and segmental changes in consumer demographics, the purchasing power of "County Madams" is enriching the interpretation of "She Economy," attracting numerous brands. Hema, Lululemon, Chow Tai Fook, L'Occitane, and Starbucks are all accelerating their expansion into lower-tier cities.

Even the secondhand luxury market (hereinafter referred to as "pre-owned luxury"), where 70% of core consumption is concentrated in first-tier cities, is expanding its business to target these "County Madams."

"When I first started, almost all orders were online. Now, offline orders in Luzhou have reached parity with online orders. During this year's Spring Festival, we achieved over one million yuan in turnover."

Luzhou, Sichuan, is a third-tier city with a population of 4.267 million. In 2022, the per capita disposable income was only 32,900 yuan. Mr. Ma has been operating a pre-owned luxury store in Luzhou for five years. His store, Xianli Pre-owned Luxury, is located near a residential area in Luzhou's urban center.

On Xiaohongshu, there are over 3.5 million notes related to "pre-owned luxury" and "vintage bags," covering daily outfits, bag recommendations, and purchase experience sharing. Even more popular is the topic of "opening a pre-owned luxury store in a small county," with 7.23 million notes. Many pre-owned luxury professionals have seized this trend, aiming to capture the hearts of "County Madams."

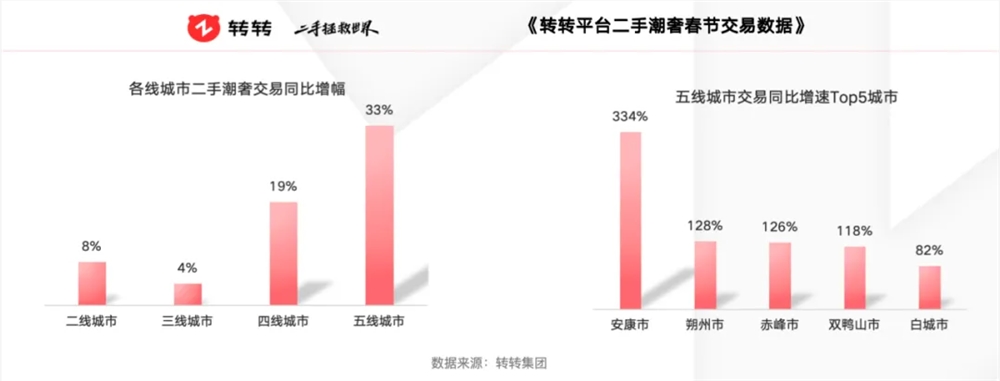

During this year's Spring Festival, pre-owned luxury transactions in non-first-tier cities experienced explosive growth. According to ZhuanZhuan's released Spring Festival data (January 5th to February 5th, 2025), year-on-year growth in secondhand luxury transactions in fourth- and fifth-tier cities reached 19% and 33%, respectively. The platform's 2024 national regional data on secondhand luxury transactions also shows double-digit growth in third- and fourth-tier cities, with fifth-tier cities experiencing an 8% year-on-year increase compared to 2023.

This Women's Day, "E-commerce Online" interviewed several consumers, entrepreneurs, and professionals in the pre-owned luxury industry to understand how, after urban white-collar workers, County Madams have become the focus of attention and a key consumer group for businesses.

Self-Indulgence Fuels Fashion Demand

“That’s a vintage Prada bag; you have great taste.” Zhang Xuan, living in a fourth-tier city in Anhui province, didn't expect her new vintage Prada bag purchased during the Spring Festival to be noticed so quickly by her colleagues and friends.

“It feels like everyone is becoming more discerning, and more accepting of pre-owned luxury goods.” For Zhang Xuan, who has always lived in a small city, the resources and wealth accumulated by her parents have freed her from financial pressure. Social media has exposed her to pre-owned luxury through fashion bloggers, and since her favorite vintage bags are only available in the secondhand market, buying pre-owned luxury is a natural choice for her.

“My parents' generation might feel it's embarrassing to use secondhand items, but I personally don't think so. It's a great way to buy a luxury item I like at a good price, and it's environmentally friendly.”

Mengmeng, a 25-year-old teacher from a county, is also a pre-owned luxury enthusiast. After completing her undergraduate and graduate studies in a first-tier city, she returned to her hometown. Her income isn't high, but the job is stable.

She scoffs at the notion that buying pre-owned luxury is about vanity. “That's outdated thinking. Quality of life isn't just about carrying a couple of luxury bags. While there might be some element of showing off, people are mostly showcasing their fashion sense – it's perfectly normal.”

Many "returners" like Mengmeng are choosing to move back to smaller cities. Baidu Migration Index shows a net outflow from first- and second-tier cities and a significant net inflow into third- and fourth-tier cities between April 2021 and April 2024. Their tastes and consumption habits remain aligned with those developed in larger cities.

Mr. Ma of Xianli Pre-owned Luxury is also a "returnee." His time in Chengdu during university fostered his love for fashion and introduced him to the pre-owned luxury market. After graduating and returning to Luzhou, he decided to start a pre-owned luxury business in his hometown. “In the early days of opening the store in 2020, orders were mainly online, with high purchase frequency from Chengdu and Chongqing. In recent years, with the increased use of live streaming and changing perceptions, pre-owned luxury consumption has become increasingly common.”

The rise of live streaming is a crucial factor in the pre-owned luxury trend reaching lower-tier markets. According to the "Research Report on the Retail Industry of Idle High-end Consumer Goods in China," before 2016, the pre-owned luxury industry was primarily regional offline recycling and trading. After major pre-owned luxury businesses introduced live streaming, in 2020, the GMV (Gross Merchandise Volume) of pre-owned luxury goods on Douyin reached 3 billion yuan.

"99% new, clean interior, 3, 2, 1, link in bio." This is a common phrase used by a pre-owned luxury streamer Mengmeng frequently watches. Her live streams often feature avant-garde luxury bags. Last year, Mengmeng spent around 30,000 yuan on pre-owned bags through live streams. According to Mengmeng, popular streamers often have exclusive sources, so finding the desired bags requires patience and watching different streamers and stores.

Besides smaller streamers, many celebrities have also promoted pre-owned luxury goods on live streams. In 2022, Hu Bing sold tens of thousands of pre-owned luxury bags in a single live stream, generating over 100 million yuan in sales. Other celebrities like Xiang Tai (Chen Lan) and Cao Guiren (Chen Sisi) continue to host pre-owned luxury live streams.

The New Wave of Women's Consumption Isn't Just About Emotions

As a significant branch of the fashion industry, the pre-owned luxury market primarily caters to female consumers. According to a survey on circular fashion industry trends, women account for over 90% of consumers, with a clear trend toward younger demographics. Women aged 18 to 35 are the main consumer group.

In lower-tier markets, the strong purchasing power of "County Madams" makes them a core consumer group for pre-owned luxury. Data released by the "2024 Study on High-Quality Development of China's County Economy" shows that the number of "billion-yuan counties" (counties with a GDP exceeding 100 billion yuan) increased from 9 to 59 between 2013 and 2023. The retail sales of consumer goods in China's county areas reached 46.3% in 2023. McKinsey also predicts that by 2030, 66% of China's personal consumption growth will come from county-level cities.

However, this doesn't mean that it's easy to make money from "County Madams." Women's consumption is no longer solely driven by emotional appeals. While they pay for fashion, they also follow current mainstream consumption patterns: rational, cautious, and value-driven.

According to Mr. Ma of Xianli Pre-owned Luxury, he has a VIP customer who buys 3-4 bags a month on average. Buying pre-owned luxury is a more cost-effective choice for her. "An LV bag costing over 10,000 yuan in a store is typically half price in the secondhand market. For this customer, who buys nearly 30 bags a year, buying pre-owned saves her tens of thousands of yuan annually."

“County Madams” also differ significantly from those in first-tier cities in terms of average order value and purchase preferences. Kwan, a senior pre-owned luxury operator, told us that consumers in third- and fourth-tier cities prefer classic designs and lower price points, while those in first-tier cities prioritize brand recognition and trending styles. Qiqi, who moved from Shanghai to Nanning to work in the pre-owned luxury business, said that customers in Shanghai prefer higher-priced Chanel bags, while in Nanning, LV is more in demand.

Furthermore, compared to urban white-collar workers, "County Madams" are more meticulous in verifying product condition and authenticity. Xu Qing, who has worked in sales for several pre-owned luxury brands, said that unlike consumers in first-tier cities, customers in county-level cities ask more frequent questions about product condition, including hardware quality, and request more detailed photos from multiple angles.

Lu Xi, the operations director of Zhong Hengxin Commodity Appraisal Center, told "E-commerce Online" that compared to the first half of last year, their appraisal volume has increased by nearly 30%. The areas where appraised goods are sent have also expanded from the previously common Beijing, Shanghai, and Guangzhou to across the country.

Beyond purchasing, the continuous improvement of "seamless circulation" services on various platforms has lowered the barrier to entry for ordinary middle-class consumers in county-level cities to purchase pre-owned luxury goods. Mengmeng is a prime example. She not only buys pre-owned bags online but also successfully resells them. "99% or 95% new pre-owned bags are virtually indistinguishable from new ones, but the price can be several thousand yuan lower. It's less painful to resell them when I'm tired of them."

Lu Xi told "E-commerce Online" that since the second half of 2024, they've observed a significant increase in the frequency of goods circulation, with some items being submitted for inspection multiple times within three months. The range of brands and types of goods in circulation has also expanded significantly, indicating that consumers are increasing the frequency of pre-owned luxury circulation and their demand for authentication is becoming more rational and mature.

Winning Women's Hearts Isn't Easy; Expanding into Lower-Tier Markets Has No Shortcuts

Driven by demand, many major pre-owned luxury brands are seeking to further penetrate lower-tier markets.

According to a report by Yicai Global, the pre-owned apparel brand Chaoshaohu recently opened a store in Yibin, a third-tier city in Sichuan. Its manager stated, "I believe that the future development of third-tier cities will drive the development of pre-owned luxury goods, achieving regional localization and omnicanalization."

"Many online stores claim 'no refunds or exchanges unless the item is fake.' If there are flaws not clearly shown in the details, it's difficult to get a refund or exchange," Zhang Xuan said, expressing her hope for more offline pre-owned luxury stores in county-level cities. "Seeing is believing."

It's clear that with more players entering the market and the widespread use of online platforms, the pre-owned luxury market is becoming increasingly transparent. Many consumers are more familiar with product value than the sellers.

"The pre-owned luxury industry is maturing, and so is consumer awareness. Low-cost sources are no longer easily available. Most businesses, whether B2B or B2C, are focusing on high-quality goods and a positive customer experience." In Kwan's view, the pre-owned luxury industry has reached a stage where "quality is king."

As non-standard products, pre-owned luxury goods lack a unified pricing standard. Condition, age, and previous owners all affect the price. In the past, sellers could leverage information asymmetry to control pricing and occasionally find bargains. However, with increasing market transparency, making money is no longer easy.

Looking at the broader "women's business," brands targeting women have experienced ups and downs, with many failures. The market is becoming increasingly challenging. This trend is irreversible as the market consolidates and consumer awareness improves.

This means that expanding into lower-tier markets and capturing core "County Madam" users requires no shortcuts. The women's market will increasingly test businesses' competitiveness in product quality, consumer service, and brand reputation.

As Mr. Ma of Xianli Pre-owned Luxury responded to concerns about the impact of larger brands entering the market, "Trust is key. I've built a loyal customer base in Luzhou, Chengdu, and Yibin. Pre-owned luxury is a high-ticket item business, and word-of-mouth is crucial." Next month, Xianli Pre-owned Luxury will open a new store near the Wanda Plaza in Luzhou, hoping the increased foot traffic will bring new business.

"In the long term, the outlook for the pre-owned luxury market is optimistic," Kwan also said. With the future development of standardized authentication, evaluation, grading, and pricing, along with the establishment of a sound market regulatory mechanism, the pre-owned luxury market will become healthier.

Regarding the controversy that buying pre-owned luxury is "refined poverty," as Mengmeng said, "Life is a matter of choice, and I spend money to be happy." As a new generation of female consumers, instead of dwelling on such controversies, they should uphold their rights as consumers regarding product quality and consumption experience, choose brands and businesses that respect them, and seek better consumption experiences and environments. "Keep the good, discard the bad."

Whether it's white-collar workers in Beijing, Shanghai, and Guangzhou, or "County Madams," female consumers have moved beyond naivete and are no longer easily swayed by consumerism. With the rise of female consumer freedom, women are reshaping consumer culture. In different consumption choices, every "individual" should be respected.

In short, for brands and businesses to achieve sustainable growth, "how to better serve her" is an unavoidable question.