New data reveals a rapidly shifting AI market in 2025, with businesses and consumers quickly changing how they use AI tools. Poe, a platform hosting over 100 AI models, released a comprehensive report detailing user interaction patterns over the past year, offering insights into text, image, and video generation technologies.

Poe's analysis, based on millions of user interactions, provides crucial market insights for technology decision-makers. In this rapidly evolving ecosystem, usage data is often closely guarded. The Poe report notes that as AI models continue to improve, they will increasingly become central tools for knowledge acquisition, complex task handling, and daily work management.

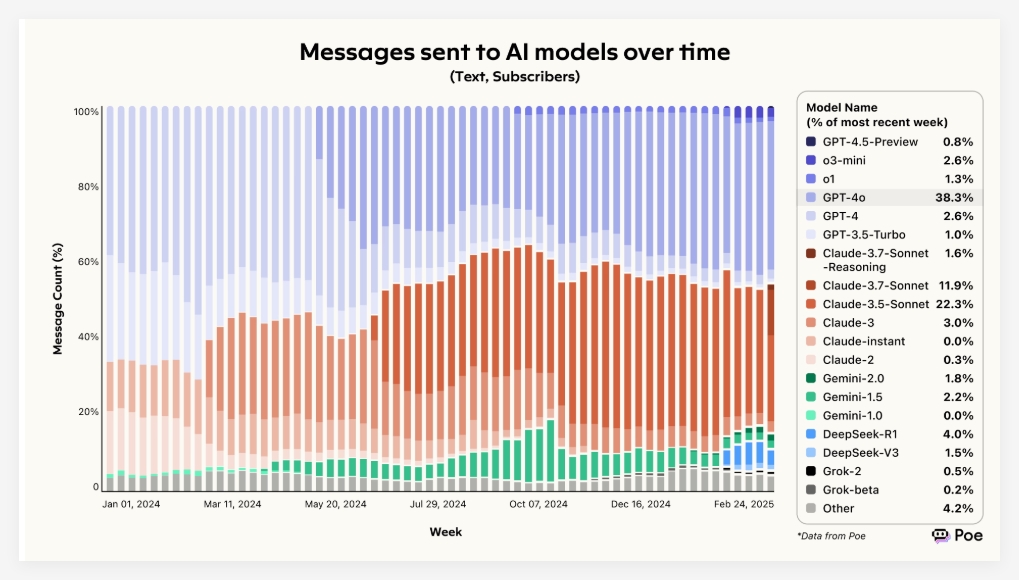

The report shows an increasingly fragmented market for various AI technologies. While OpenAI and Anthropic still dominate text generation, newcomers like DeepSeek are rapidly emerging in this space, and Black Forest Labs is making significant strides in image generation, highlighting the intensifying competition.

Google's performance varies across different AI sectors. In text generation, Google's Gemini model saw growth until October 2024, but subsequently declined. In contrast, its Imagen3 captured 30% of the image generation market, while its video generation model, Veo-2, quickly secured 40% of shareable content. This mixed performance demonstrates that technological excellence doesn't guarantee market leadership.

Video generation, a nascent area of generative AI, is highly competitive, with leadership shifting rapidly. The report notes that over eight providers have entered the fray since the emergence of video generation models in late 2024. Google's Veo-2 quickly captured nearly 40% of the market share in early 2025, while early leader Runway dropped to 31.6%.

The image generation market has seen a significant shift. Early models like DALL-E-3 experienced a usage drop of nearly 80%, while newcomer Black Forest Labs' Flux series models emerged as a dominant force, capturing nearly 40% market share.

Poe's data also suggests that AI companies may be at risk by investing in maintaining older model versions. Users quickly migrate to the latest flagship products with new model releases, leading to a dramatic decrease in the usage frequency of older versions. This phenomenon is widespread across companies, prompting a reconsideration of product lifecycle strategies.

In the text generation arena, OpenAI and Anthropic's dominance faces new challenges. While the two companies together hold approximately 85% of the market share, DeepSeek's rapid rise suggests that new competitors are disrupting the landscape, and the market barriers may not be as high as previously thought.

Key Highlights:

✨1. Google's performance in AI varies; it faces challenges in text generation.

🎥2. The video generation market is fiercely competitive, with Google's Veo-2 rapidly gaining ground.

🖼️3. The image generation market is undergoing a massive transformation, with Black Forest Labs taking the lead and DALL-E experiencing a sharp decline in usage.