With the advancement of internet technology, the tactics of telecom network fraud continue to evolve, posing a serious threat to public property safety and legitimate rights and interests. The Financial Consumer Rights Protection Bureau of the National Financial Supervisory Administration has issued a risk alert, reminding the public to enhance their awareness of prevention.

The types of fraud mainly include:

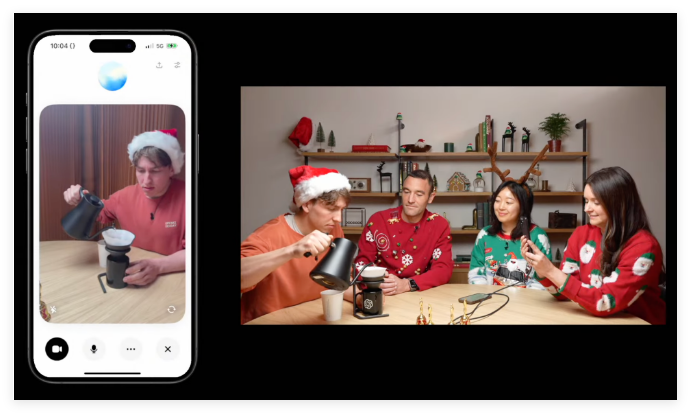

1. "Screen Sharing" Fraud. Criminals use the pretexts of "increasing credit card limits," "cancelling fictitious loans under one's name," "terminating insurance services," "refunding for flight delays," or "offering gifts" to send text messages or make phone calls to individuals, luring them to download designated chat software or online video conferencing software. They then instruct individuals to enable the "screen sharing" feature of the software, allowing the criminals to "real-time monitor" the individual's phone or computer screen. They "guide" the individual to perform operations such as binding bank cards and changing passwords, simultaneously obtaining important information such as bank account details, passwords, and verification codes, thereby stealing funds from the bank card.

2. "AI Face-Swapping and Voice Mimicry" Fraud. Criminals use the pretexts of "online store customer service," "marketing and promotion," "recruiting part-time workers," or "online dating" to contact consumers via WeChat, phone, etc., collecting voice, sentences, or facial information. They use "face-swapping" and "voice mimicry" technologies to synthesize false audio, video, or images of consumers, imitating the voices or appearances of others to gain trust. They then deceive the individual's friends and family into transferring money or providing sensitive information such as bank account passwords under the pretext of borrowing money, investing, or emergency assistance, and immediately transfer the funds. In addition, criminals may artificially synthesize audio and video of celebrities, experts, law enforcement officers, etc., impersonating their identities to spread false information and achieve the purpose of fraud.

3. Fraudulent Online Investment and Wealth Management. Criminals falsely claim to invest in bonds, stocks, precious metals, futures, etc., and post messages on online platforms claiming "guaranteed profits," attracting public attention. They then add individuals to "investment" group chats and impersonate investment mentors or financial experts, using "expert inside information" and false news to induce investment. Or, through online dating platforms, they establish romantic relationships with individuals and then use the pretext of having "inside information" or "special resources" to deceive individuals into participating in investment. They guide individuals to invest on counterfeit or fake investment platforms and use small investment returns as bait to continuously induce individuals to increase their investment, and then quickly transfer the funds.

4. Fraudulent Online Game Product Transactions. Criminals post false information about game accounts, equipment, and points cards for sale in online games or social platforms, using the gimmick of "low-price sales" or "high-price acquisitions" to attract the attention of gamers. For players looking to buy game products at low prices, criminals lure them to bypass official game trading platforms and conduct offline transactions with them. Once the player pays, the criminals disappear. For players looking to sell game products at high prices, criminals deceive them into logging into fake trading websites to conduct transactions and use various excuses to require players to pay a deposit, handling fee, etc. before they can "withdraw funds," continuously asking players to top up more money, and then quickly transferring the funds.

To prevent fraud, the public should:

Be vigilant: Do not easily believe in high-return investments, free gifts, etc., and invest rationally.

Protect personal information: Do not disclose ID numbers, bank card numbers, passwords, etc., and refuse requests for "screen sharing."

Be cautious when transferring money: Verify the authenticity of information and do not easily transfer money to strangers.

Seek legitimate channels for rights protection: Resolve economic disputes through legal means, report to the police promptly, and preserve evidence.

The National Financial Supervisory Administration recommends that the public choose wealth management products through legitimate financial institutions, enhance their ability to recognize and prevent scams, and avoid property losses. At the same time, it reminds the public to take timely action when encountering fraud to protect their own legitimate rights and interests.