Datricks, a startup based in Tel Aviv, Israel, has recently secured $15 million in an A round of funding, led by venture capital firm Team8, with participation from global enterprise software giant SAP and existing investor Jerusalem Venture Partners (JVP).

Founded in 2019, Datricks initially started as a consultancy by founders Haim Halpern and Roy Rozenblum before pivoting to become a software company to achieve greater scalability.

Datricks' financial integrity platform focuses on automating the analysis of financial workflows through an AI-driven approach called "risk mining," covering business systems such as SAP, Oracle, and Salesforce. It aims to monitor an organization's financial data in real-time, detecting financial anomalies, fraud patterns, and compliance issues to help companies reduce potential financial losses and reputation risks.

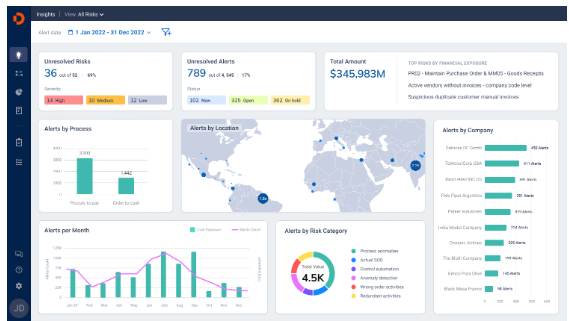

Enterprises worldwide lose up to 5% of their annual revenue to fraud, amounting to approximately $4.7 trillion. Traditional compliance and audit processes often fail to effectively identify these risks, whereas Datricks' platform ensures higher accuracy and fewer false positives by continuously monitoring 100% of financial data.

The core of the Datricks platform consists of three parts: first, autonomous process discovery, which automatically analyzes financial processes without manual input, monitoring and identifying issues in real-time. Second, integrity exposure detection, which analyzes all business transactions in real-time to uncover potential fraud and compliance issues. Lastly, integrity intelligence, where financial leaders can gain comprehensive insights into the organization's financial health through dashboards and respond swiftly.

Datricks' advantage lies in its ability to start identifying risks within just one week without any configuration. Through this "seven-day challenge," Datricks demonstrates its powerful AI capabilities, providing actionable insights quickly. The platform's success has helped several large enterprises avoid financial errors such as double charging, saving millions of dollars in losses.

Currently, Datricks' clients include major enterprises such as Element Solutions, HELLA FORVIA, and Teva, and it has established partnerships with top consulting firms including Deloitte, EY, KPMG, and PwC. SAP's involvement in the funding also underscores its significance in the enterprise software sector.

As digital transformation accelerates and the volume of financial data surges, Datricks aims to provide continuous financial risk management tools for businesses, ensuring financial integrity and compliance in the ever-changing business environment.

Key Highlights:

🔍 Datricks raised $15 million in its latest funding round, with investors including SAP and JVP.

🚀 The company's financial integrity platform uses AI technology to monitor corporate financial data in real-time, identifying risks and fraud.

💼 Datricks' client base includes multiple large enterprises and has partnerships with several renowned consulting firms.